차에서 듣고 싶은 곡

새로 주문한 차가 8월이면 올 것 같다.

스피커에 많은 신경을 썼는데

밤에 혼자 드라이브를 하면서

꼭 듣고 싶은 곡들이 있는데

새벽 2시

자유로, 올림픽대로, 강변북로를 달리면서

차 안에서 울려퍼질 그 때를 기다린다.

그 때를 기다리는 것이

무력하고 건조하고 어려운 요즘

나의 거의 유일한 낙이다.

새로 주문한 차가 8월이면 올 것 같다.

스피커에 많은 신경을 썼는데

밤에 혼자 드라이브를 하면서

꼭 듣고 싶은 곡들이 있는데

새벽 2시

자유로, 올림픽대로, 강변북로를 달리면서

차 안에서 울려퍼질 그 때를 기다린다.

그 때를 기다리는 것이

무력하고 건조하고 어려운 요즘

나의 거의 유일한 낙이다.

대표이사 사임에 따라 퇴직금 6,222,222원을 받았다.

요즘 법이 엄격해서

임원도 퇴직금으로 인정받을 수 있는 한도액이 정해져있다.

그 한도액을 넘으면 근로소득으로 인정된다.

그렇게 그 금액이 내 통장으로 들어오는 것을 보면서

형언할 수 없는 기분이 들었다.

대표이사로서

지난 5년간 경험하고 싸우고 슬퍼하고 분노하고 느끼고 배우고 깨닫고 괴로워하던 그 순간들에 대한 댓가이다.

그 회한을 글로 모두 담을 수 없다.

영등포는 그래도 전통시장도 근처에 있고 해서

전반적으로 물가가 다소 낮은 편이긴 하지만

그래도 점심 식사비용을 아껴보고자 알아본 끝에

영등포구청 구내식당이 새로 리뉴얼 했다 해서 가봤다.

5,300원이다.

앞으로는 여기를 주로 이용할 것 같다.

지하철 한 정거장 거리이긴 하지만

킥보드를 타고 가면 금방 간다.

메뉴와 가격 고민하지 않고 갈 수 있는 곳을 찾아서 기쁘다.

비엔나에서 야간 버스(flix bus)를 타고 부다페스트 공항에 가서

부다페스트 공항에서 바르샤바를 경유, 서울로 오는 일정이었다.

새벽 2시에 일어나 짐을 챙겨

새벽 3시 50분 버스를 기다렸다.

분명히 flix bus를 비엔나 중앙역에서 부다페스트 공항까지로 표를 구매했었고

도착 예정시간보다 30분 일찍 옆에 있던 사람이 날 깨우더라

사람들이 모두 내리고 있길래

내가 Airport냐고 물어보니 맞다고 하였다.

그래서 얼떨결에 내리고 보니, 여기는 부다페스트 버스터미널이었지 공항이 아니었다.

옆 승객에게 물어볼게 아니라 기사에게 물어봤어야 했다.

비행기 출발하기까지 시간도 별로 없는데

당황한 나머지 이리저리 생각을 해보다가

구글 맵에서 알려준 것 처럼

Bolt라는 앱을 급히 깔아서 택시를 불렀다.

한국에서도 카카오 택시, 타다 이런거 안써본 사람이

급하니까 외국에서 우버같은 앱을 처음 써본 것이다.

카드로 결제해서 환전필요는 없었다. 좋은 세상이다.

그렇게 4만원 정도를 써서 20분이 안되어 공항에 도착했다.

올 때까지 다이나믹했구나,

그래 좋은 경험 했다.

이런 것도 하나의 추억거리로 남으리라.

이번 여행에서 가장 유용했던 제품을 뽑아본다면

속건 타올일 것 같다.

호스텔마다 타올을 유료로 빌려주거나하는 곳들이 있어서

한국에서 하나 사 갔는데

크기도 크지만 얇아서 부피도 덜 차지하고

빠르게 마르면서

타올로서 할 기능은 다 해서 매우 만족스럽다.

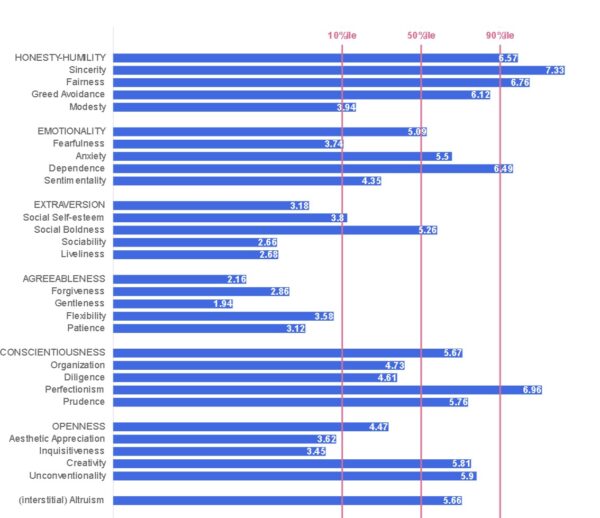

HEXACO 테스트를 해보았다.

https://survey.ucalgary.ca/jfe/form/SV_0icFBjWwyHvJOfA

MBTI와 얼핏 비슷하면서도 조금 다른데

인간의 내면을 더 디테일하게 파고들었다는 느낌을 받았다.

내가 보기엔 두 가지 특징이 있는데…

1.

성실성과 창의성은 역의 상관관계에 있다고들 보통 말하는데

(성실성이 높으면 창의성은 낮음)

나는 성실성과 창의성이 모두 높다.

내가 창의성이 그렇게 높은지는 모르겠지만,

항상 한 발 물러서서 다른 각도로 생각해보려고 하고

문제를 해결하기 위해 다양한 방안을 찾아보는 것은 맞긴 하다.

성실하면서도 창의적인 것은 내 큰 장점이라 생각한다.

2.

반면, 나에게 손해를 끼친 타인에 대한 용서/너그러움은 매우 낮은 편인데

이 역시 내가 남에게 손해를 안주었으니 나도 손해를 입어서는 안된다는 기본 생각 외에

회사를 운영하면서 무수히 많은 사람으로부터 배신과 피해를 입으면서

그러한 태도가 더 심화된게 아닌가 하는 생각이 들어서

나 스스로 좀 안쓰럽게 느껴졌다.

엔비디아가 AI 붐에 힘입어 실적이 더 좋아짐에 따라

주가가 폭등 했다.

엔비디아 주식이 이미 비싸다 생각해서 한 주도 사지 않은 나로선

AI 붐을 알고 있으면서도 이를 외면하여 속이 쓰리다.

하지만, 당시 많은 전문가와 투자자들도 엔비디아의 실적에 대해서는

반신반의하고 있었으므로 이렇게 될지는 나 뿐만 아니라 시장도 몰랐다는 것이 맞고

최근에 정립해나가고 있는 내 투자 원칙과도 맞지 않으므로

어쩔 수 없다는 생각도 든다.

아쉽지만 내가 할 투자는 아니었다 생각한다.

밀라노에 있다.

스폰티니에서 이태리 현지인들 사이에 껴서

마르게리따 피자 한 조각을 먹다가

내가 죽으면 나의 소박한 재산은 어떻게 할 것인가 잠시 생각해보았는데,

나에게 배우자나 자녀가 없다면

이 재산은 사회에 돌려주어야겠다는 생각이 들었다.

그런데, 이것을 어느 곳에 금액으로서 기부하기보다는

다소 품이 들지만

작은 장학/복지재단을 만들어서

현금은 SCHD와 같은 배당 ETF나 리얼티인텀과 같은 리츠 주식을 사고

부동산은 임대수익을 받아서

이 임대수익과 배당수익을 합쳐서 내가 원하는 곳에 기부하거나 물품을 사주면

되겠다는 생각이 들었다.

현재로서는 그 금액이 얼마나 될지 모르겠지만

아마도 최소 1년에 1억은 될 수 있지 않을까 싶다.

그러면 되겠다. 방법을 미리 찾아봐야겠다.

작년부터

주식 시작한 이후로 매매 기록을 모두 구글시트에 저장하고

각 나라별로 수익률을 비교할 수 있는 파일을 만들었다.

증권사도 2-3곳을 쓰고 있기 때문에

나는 이런 작업을 필히 해야 한다.

처음에는 귀찮았지만 신경을 써서 만들어놓으니

매매기록 자체는 수작업으로 입력해야하긴 하지만

그 이후로는 전체 포트폴리오를 한 페이지에서 볼 수 있어서 매우 유용하다.

평소에서 사용하긴 했지만

여행중에 가장 유용한 제품을 꼽으면

이런 3 in 1 멀티케이블이 아닐까 싶다.

5핀, c타입, 애플을 모두 충전할 수 있는 케이블인데

하나만 가지고 있어도 다양하게 사용이 가능해서 매우 유용하다.